FAQ: Monthly Comic Shop Market

Distributor Sales Charts

What a tool created as an aid for comics shops

tells us about comics circulation history

by John Jackson Miller

If you're visiting Comichron for the first time, odds are you were brought here by a link to the monthly comics shop order data that has been part of this site since the beginning — and which I began generating monthly estimates for back in 1996. Here's some background on them and guidance on what they should and shouldn't be used for:

Q: When did comic-book distributors first start releasing sales charts?

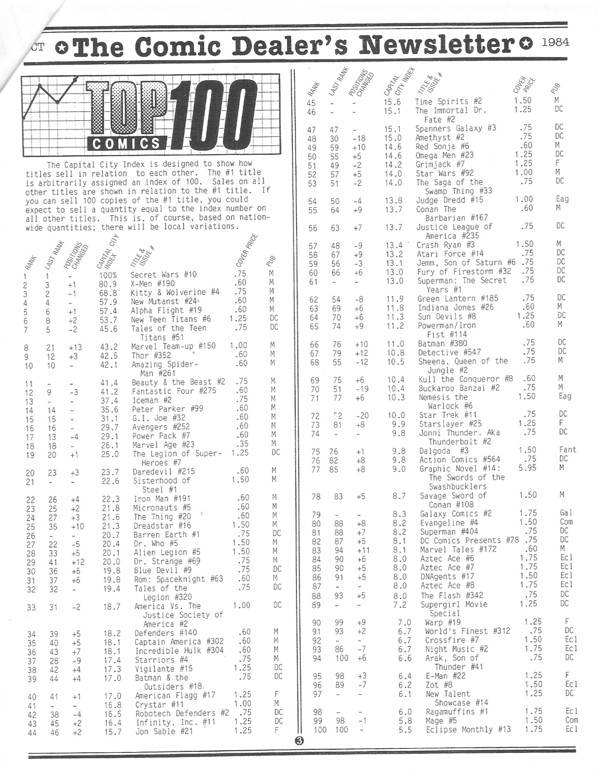

A: Capital City Distribution began releasing rankings in its "Internal Correspondence" newsletter in the early 1980s. Capital was also the first to introduce the "order index number," reporting what the sales of all titles were relative to a single benchmark title, usually one of the best-sellers. Diamond Comic Distributors, which began running rankings in the late 1980s, later adopted the order index procedure, which it continues to use today in its reports.

A: Capital City Distribution began releasing rankings in its "Internal Correspondence" newsletter in the early 1980s. Capital was also the first to introduce the "order index number," reporting what the sales of all titles were relative to a single benchmark title, usually one of the best-sellers. Diamond Comic Distributors, which began running rankings in the late 1980s, later adopted the order index procedure, which it continues to use today in its reports.

The first Capital City chart with order index numbers, from October 1984, can be seen at right. Click to see an enlarged version.

Q: Why did distributors begin using the order index numbers?

A: It's important to remember that while the distributor sales charts in the internet age are available to the general public, they were first intended solely for the use of retailers in figuring out what their relative order levels should be. If the average retailer is ordering 50 copies of a title for every 100 copies of Batman and you're only ordering 10 copies for every 100 copies of Batman, you are probably missing out on demand that exists for the title.

Q: Why did distributors mess with order index numbers? Why not print the actual sales figures?

Q: Why did distributors mess with order index numbers? Why not print the actual sales figures?

A: Comics distributors are the sales representatives of publishers and are obliged not to give up too much information. Also, in the days when there were multiple distributors, the distributors themselves did not want to reveal their competitive strengths and weaknesses.

Q: How does Comichron derive the actual number of copies sold to retailers?

A: For most of the distributor tables on Comichron, we've employed the same method everyone else has for years: with reports from one or more publishers on what they actually sold to distributors, the entire chart can be unlocked. I began my monthly decoding of the charts in September 1996, and have been working to gather the information needed to figure out earlier months.

Additional resources known to be dependable have become available in some circumstances, and those further advise the estimates.

Q: How accurate are the estimates?

A: Before February 2003, Diamond was reporting preorders, and in that era, the margin of error was higher. I used a basket of publishers' actual sales figures to derive a likely estimate for the Order Index Numbers — and found that there was significant variance because the publishers did not get their purchase orders at the same time relative to the moment Diamond calculated its charts. But after that date, Diamond switched to reporting final orders — and while that meant that the charts came out later than they did in the preorder days, suddenly, all the variance between publishers' reports vanished. This is why estimates computed by Comichron, ICV2, and ComicBookPage are often identical. The same math obtains everywhere now.

Q: What is included in the Diamond monthly charts?

A: Beginning in February 2003, the Diamond charts report the number of copies it shipped to retailers from its warehouses in North America during the calendar month. Sometimes, the books may actually arrive in the next calendar month, but they're invoiced based on the day they leave the facilities. So occasionally you'll see a January where the first week's sales actually are reported with December.

Note that some of the comic books Diamond ships are

to vendors outside the comics shop market. This includes subscription box services like Loot Crate; because the services bought the comics directly from Diamond, the figures are included in the tallies. In cases were the majority of comics went outside the comics shop market, we usually note that in our tables.

Q: What is NOT included in the Diamond monthly charts?

A: This is important, because it is a topic often misunderstood. Not included are:

• copies shipped outside the calendar month, including most reorders

• copies sold outside North America; the UK market often adds 10% or so

• copies sold outside the comics shop distribution network, such as on newsstands, in bookstores, or by postal subscription; this also includes graphic novels that Diamond's sister branch, Diamond Book Distributors, sells returnably to book channel outlets

• copies that comics shops bought from anyone besides Diamond, such as other book distributors or direct orders from publishers

• copies that of comic books whose publishers do not have distribution agreements with Diamond, which should be fairly obvious; beginning in July 2020, this includes all DC comics, with most but not all of Marvel and IDW leaving for Penguin Random House in October 2021 and June 2022 respectively

• and anything digital. There is no source for digital sales figures on individual titles.

Furthermore, since the early 2000s, Diamond has omitted from its comics sales charts those books which are promotionally priced — usually, anything below a dollar. This includes Free Comic Book Day comics. The comics are sometimes, but not always, still included for purposes of market share and overall market size computations. Just not the rankings: it is highly unlikely publishers are making a profit on these titles, and putting them in with regular comics tends to distort the rankings.

Click here to read a more detailed discussion of the issues involved with what is and isn't counted.

Q: When a publisher says the sales of their titles are higher than what are seen in the distributor charts, are they telling the truth?

A: Absolutely, because of the reasons stated above. Publishers see different numbers: more than just North America, more than just the calendar month, more than just Diamond. What the distributor presents is a subset of sales — a very large subset whose size relative to the whole will vary from product to product and from publisher to publisher.

In the modern era, it is not uncommon for a project to make the majority of its sales outside the monthly comic book charts. There are multiple examples of titles which might only sell 10,000 or 20,000 copies of the monthly periodical through Diamond, but which have existed long enough to generate a sizable library of hardcover and softcover collected editions, which sell not just through Diamond, but through book channel and digital outlets.

Q: Does the shipping calendar impact what portion of comic book's print sales Diamond's chart represents?

A: Yes. The fact that comics may ship in the first or last week of the month introduces volatility; a title shipping in the last week of the month is significantly handicapped. Two comic books with exactly equal overall sales might appear 10% apart or more in units if one shipped on the first week of the month and the other shipped the last week. The second book's shipments would all be counted in the next month's report, but reordered periodicals infrequently make the Top 300 so we wouldn't see them. (When Diamond shifted in 2017 to reporting the Top 500, more reordered data began to be captured, but it still reflects a small minority of items sold.)

For that reason, Comichron tends not to do cross-time analyses of titles based on the monthly data. The aggregate figures tend to be a better barometer of industry health. Read more about the volatility factor here.

Q: If the aggregate figures are a better barometer, then why do you publish the monthly sales of individual titles?

A: Because they're what we have—they're the building blocks on which the overall figures are based. They serve their original purpose, as an inventory control aid for retailers. And there is an audience specifically interested in how many copies are in circulation: the secondary market. Comichron's data establishes a minimum number of copies that made it to stores.

Q: Why do the Diamond charts sometimes skip entries, going from #300 to, say, #314?

A: Diamond (with the exception of a few months in 2013-14 when it released the Top 400) has always released the Top 300, but has also released Top 50 lists for Small Publishers (those with market shares below 1%) and Independents (non-Marvel and non-DC Publishers with shares above 1%). The Small Publisher list ended in 2018 after Diamond shifted to publishing the Top 500. There's also a Top 50 for Manga.

There is some overlap with the Top Sellers, but some of these lists yield some additional entries, which we add to the overall chart. However, the aggregate sums for each month remain based on just the Top 300, in order to ensure an equal cross-time comparison.

It may be assumed that any missing entries sold between the sales levels of the known items, and that the highest missing items are likely from the larger publishers.

Q: What is the dollar sales ranking and what does it mean?

A: Diamond also releases a ranking for each title that is based on the number of wholesale dollars — that is, what retailers paid Diamond — for each item. If an item has a cover price that is more than average, its dollar ranking might be closer to the top of the chart than its unit ranking — but it also might not, because the key is what retailers paid. An item which is sold at a deep discount, for example, would have a dollar ranking much further down the charts from its unit ranking; this happens often with graphic novels during sales, and occasionally on the comics charts where free or discounted overships are offered.

Even then, two books with identical cover prices and unit sales may

see their dollar rankings diverge, because the retailers ordering any given item are at different discount tiers depending on their sales volume.

Q: What are overshipped copies, and why are they included?

A: Publishers often give retailers an additional incentive to try out a title by providing additional copies for free; they simply overship. Diamond counts these copies as shipped, which makes sense; they're not coming back, and the extra books are in circulation so retailers and collectors would want to know that. As noted above, the presence of free overshipped copies is usually obvious from the disparity between unit and dollar sales rankings, and while overshipped copies are counted toward unit market shares, they obviously don't contribute to dollar market shares.

Q: What does it mean when it says some issues' sales were reduced for returnability?

A: While the fact that retailers buy comics from publishers outright is the basic premise of the Direct Market and integral to what's made it successful for publishers and retailers alike, publishers often offer returnability on single issues or entire new lines as a means of getting retailers to sample those titles. In those cases, Diamond reduces the number of shipped copies by a figure, usually 10%, and adds an asterisk; this tells retailers that more copies are actually in circulation, but may not stay in circulation, because of returns.

After a title's returnability window ends,

Diamond reports the book's final overall sales in its end-of-year report. From these we can see that the majority of returnable titles sell through that 90% level, and in fact many books have no net returns because of reorders.

Returnability reductions in the charts do not appear to count against dollar or unit market share; the reductions aren't "real," in the sense that they're just on the charts as an alert that those books might be coming back. Later returns would presumably be counted negatively against a publisher's market share in the months that the returns arrive.

Q: Does a comic book's performance on the distributor sales charts say anything about the profitability or prospects of the title?

A: The answer is different for every single book. The "cancellation level" concept has been part of comics mythology since the 1960s, when sales of an individual issue were all a project might expect to earn, apart from ad sales — but the idea has grown less and less relevant in recent decades. Comics projects make their money back in many ways, formats, and venues now, from graphic novel collections to digital sales.

The best-selling comic book of the latter half of the 1990s in North America was Pokémon: The Electric Tale of Pikachu #1, for which initial Direct Market orders were ultimately a tiny portion of its million copies sold. Walking Dead #1 shipped only 7,266 copies its first month, placing 233rd — a small fraction of the story's eventual audience.

The best-selling comic book of the latter half of the 1990s in North America was Pokémon: The Electric Tale of Pikachu #1, for which initial Direct Market orders were ultimately a tiny portion of its million copies sold. Walking Dead #1 shipped only 7,266 copies its first month, placing 233rd — a small fraction of the story's eventual audience.

To take a more recent example, in 2017, the Ms. Marvel line made well over $1 million from its graphic novels, more than two thirds of which sold outside Diamond; that's slightly more than the comic book made. This underscores a fact about modern comics publishing that's been true since Cerebus started doing its "phone book" collected editions in the 1980s: once any comics title's graphic novel backlist is large enough, the financial burden on the periodical is reduced, and the role of the monthly shifts more toward creating new material for more collected editions for the franchise.

Initial Direct Market shipments certainly can be a strong leading indicator of a book's future success; the first issue of Watchmen placed fifth as a comic book in its first incarnation in comics shops, beginning its march to becoming one of the most reprinted comics stories of all time. But just as monthly sales, as mentioned above, are not the whole picture for publishers anymore, there have also been cases where comics which sold strongly as individual issues did not go on to longevity either as series or in reprint form, particularly in the early 1990s. So the answer, again, is "it depends."

Q: Are manga counted in Diamond's comic-book sales charts?

No — apart from one exception from the early days. Manga are essentially graphic novels, published with spines and ISBN numbers for permanent stock in bookstores. As such, manga appear in Diamond's graphic novel category. Years ago, there were cases where manga content had been reprinted in the traditional comic-book periodical format: Viz, Dark Horse, Tokyopop and others did this often, with most appearing in the 1980s through the early 2000s. The most successful of these was Pokemon: The Electric Tale of Pikachu #1, which sold most of its copies not through comics shops but in bags in toy stores. The practice was really designed for the early days when the small book-sized manga were not a familiar format in North America, and it largely ended after the early 2000s.

Q: What happened to the distributor charts after 2020 and the Coronavirus pandemic?

A: Because of the pandemic, Diamond shut down shipments of new comics April 1, 2020. No new comics came from it again until late May. In the meantime, DC left Diamond for a pair of new distributors — of which only one remains, Lunar Distribution. To date, neither distributor has ever released any information that might be used to calculate sales.

A: Because of the pandemic, Diamond shut down shipments of new comics April 1, 2020. No new comics came from it again until late May. In the meantime, DC left Diamond for a pair of new distributors — of which only one remains, Lunar Distribution. To date, neither distributor has ever released any information that might be used to calculate sales.

Beginning with its April report, Comichron drew upon a sizable sample of retail initial orders to generate rankings — and we were able to use it to put DC and Diamond comics in the same report, since the data set had orders for both.

Diamond returned briefly to reporting some sales rankings in the summer of 2020, but they did not include the Order Index data which analysts use to calculate individual issue sales. This appears in part to have been because the publishers were still ramping up and only were publishing a few comics, and comparisons with 2019 would not have been illustrative of much. Regardless, we did our own estimates in September and October based on what Diamond did provide.

But then Diamond paused its reporting again in November. The absence was seven months long, it and appears to have, at least at its origins, been due to a logistical problem — possibly exacerbated by the announcement in early 2021 that Marvel had chosen to make Random House its primary distributor as of October 2021. In any event, we resumed our practice of using retailer initial order estimates to project Diamond's sales for November 2020 through May 2021.

In June 2021, Diamond resumed publishing its reports and restored the Order Index Numbers, so it was again possible to generate charts with accurate figures. We then used our retailer initial order sample to figure out where DC comics would have fallen in an overall June 2021 chart. That practice continued until Marvel moved its distribution to Penguin Random House in October 2021, when Diamond did not release monthly charts again until January 2022. Diamond still carried Marvel comics after October 2021, but as a wholesaler — so Diamond's charts for year-end 2021 and early 2022 displayed only a portion of Marvel's sales.

Diamond continued to publish monthly charts for the first four months of 2022 — but after April 2022 it stopped releasing them, without any public explanation. It's probably that this is different from earlier pauses, as the charts only represented a fraction of industry sales, and an uneven one, at that, seeing as they had all of Image's Direct Market sales, only part of Marvel's, and none of DC's. With IDW leaving for Diamond for Penguin Random House in June 2022 and Dark Horse set to follow in June 2023, Diamond was known to have been reconsidering the best way to present its data. No monthly data appeared from anyone thereafter, though Diamond did continue running its weekly reorder charts, which can be found on Comichron.

So the Diamond Exclusive Era monthly dataset runs specifically from April 1997 to March 2020 — with varied partial and incomplete reports from Diamond following that.

Q: Will the full charts ever return?

Anything's possible. In its introduction to retailers, Random House said it was interested in providing sales charts of some kind, and Diamond could resume (and Lunar could begin) releasing detailed rankings at any time. In the meantime, we continue to archive whatever's available — and to add data to earlier years.

—Updated June 11, 2023

Month-specific methodology

The following section has specific methodological details for charts found on Comichron.

Capital City monthly charts beginning in 1985

Comichron's founder obtained the sales records for Capital City Distribution when it folded in 1996. The figures which appear in the charts are the ones from those records, generally. Occasionally, a Capital chart will include a comic book for which there was no archival sales record (often, in the case of comics that never came out); in that case we estimate based on its location in the charts relative to other issues.

Diamond monthly charts before February 2003

The monthly sales estimates are for items preordered from Diamond Comic Distributors, the largest comic-book distributor in North America.

Diamond does not publish sales figures; instead it publishes "indexed" sales tables, in which it keys orders for all comics it lists sales for to a single comic book (usually Batman), with one “order index point” being equal to 1% of that title’s orders.

Along with other methods, we use the actual Diamond final orders from titles to approximate what an order index point equals each month.The result is applied to the Diamond charts to produce the estimates.

The figures represent only those comics and graphic novels that Diamond preorded by North American retailers in the calendar month. While Diamond's sales represent the majority of periodicals in circulation, they are a smaller portion of the overall graphic novel market.

Preordered items may not have actually shipped in the month for which they were ordered — and some were not shipped at all. Such items may reappear in later preorder charts marked as resolicitations; in those cases the preorders appearing in earlier lists are cancelled.

Diamond monthly charts beginning in March 2003

The monthly estimates represent the total number of items shipped by Diamond Comic Distributors, the largest comic-book distributor in North America.

Diamond does not publish sales figures; instead it publishes "indexed" sales tables, in which it keys orders for all comics it lists sales for to a single comic book (usually Batman), with one “order index point” being equal to 1% of that title’s orders.

Along with other methods, we use the actual Diamond final orders from titles to approximate what an order index point equals each month.The result is applied to the Diamond charts to produce the estimates.

The figures represent only those comics and graphic novels that Diamond shipped to North American retailers in the calendar month. While Diamond's sales represent the majority of periodicals in circulation, they are a smaller portion of the overall graphic novel market.

An item may appear in more than one month's charts due to reorders; for a better idea of a comic book's overall sales, look for its end-of-year sales in the Year Overview section, where available.

Monthly charts beginning in April 2020

As detailed in the section above about the Coronavirus pandemic and its aftermath, Comichron tracked the entire industry fromApril 2020 and May 2021 by drawing upon a sizable sample of retailer initial orders. Rankings are provided in all cases, and sometimes sales ratios and other estimates — but they differ in many ways from what was available before.

Because the rankings are based on initial orders only, comics do not recur in the charts, and significant same-month reorder activity is also missed. In a sense, this makes the charts like the pre-2003 ones in that reorders were never included — and in another sense like even earlier Diamond charts which provided no information about sales levels.

Monthly charts from June 2021 to September 2021

Diamond returned to publising indexed data fo June 2021, boosting our estimate accuracy back to the high level it was at before the pandemic. DC comics numbers are still based on our initial order estimates, and as they include no reorders, may be presumed to be slighly below the actual circulation figures.

Monthly charts from January 2022 to April 2022

When Diamond returned to charting following a ransomware attack in late 2021, it only included its portion of Marvel, and no DC — and did not report market shares. With only a small portion of Marvel sales to draw from for comparative purposes, Comichron suspended projecting DC's sales for placement within a merged all-industry chart. Then Diamond stopped releasing monthly reports following the April one, likely to reevaluate how best to present data in the future given its reduced role within the Direct Market.

After April 2022

The April 2022 Diamond report was the final monthly chart released by any distributor in comics; the charts on our monthly pages after that are Diamond's reorders, a set of charts that the distributor still releases weekly.